Yole Développement has announced the global market share of CMOS image sensors in 2020. Here is a forecast of the current situation and the future of the image sensor industry.

Citation.:Yole Développement(http://www.yole.fr/2014-galery-Imaging.aspx)

Current Status of CMOS Image Sensor Market

The top-ranked company is Sony, with a 40% share of the market. The ranking from the top appears to be unchanged from last year (2019). As expected, Sony, Sumsung, and OmniVision are the three strongest companies. Sony, in particular, has nearly doubled its market share from second-place Sumsung with 40% by a single company. Three Japanese companies are ranked in the top three, with Sony in first place, Panasonic, and Canon at 1% each; as for Panasonic and Canon, they probably do not ship image sensors for smartphones. Therefore, they must be gaining this share from SLR (mirrorless, etc.) and industrial applications. Incidentally, as for Panasonic, it may disappear from the market share in the future since it has sold all its semiconductor business.

Image sensors for smartphones are all small sized image sensors. Canon has its own factory and manufactures its own image sensors. If Canon disappears, Sony will be the only Japanese company left, so I hope Canon will do its best.

Returning to the topic, the share of image sensors by application is probably higher for Sony, Sumsung, and OmniVision due to the high share of image sensors for smartphones.

Let’s check the share of CMOS image sensors for smartphones. According to research firm strategy Analytics, Sony has a 41% share in the second quarter of 2021. Sumsung and OmniVision follow Sony. The ranking is the same as the global share of CMOS image sensors. This can be expected because more than half of the CMOS image sensors are manufactured for smartphones. Since recent smartphones have three-lens and other types of cameras, the market share will inevitably increase. So, what is your prediction for the future?

CMOS Image Sensor Market Forecast

Until now, companies that had captured market share for smartphones went on to capture the global market share for CMOS image sensors. Will this trend continue in the future? Sony has already given its prediction.

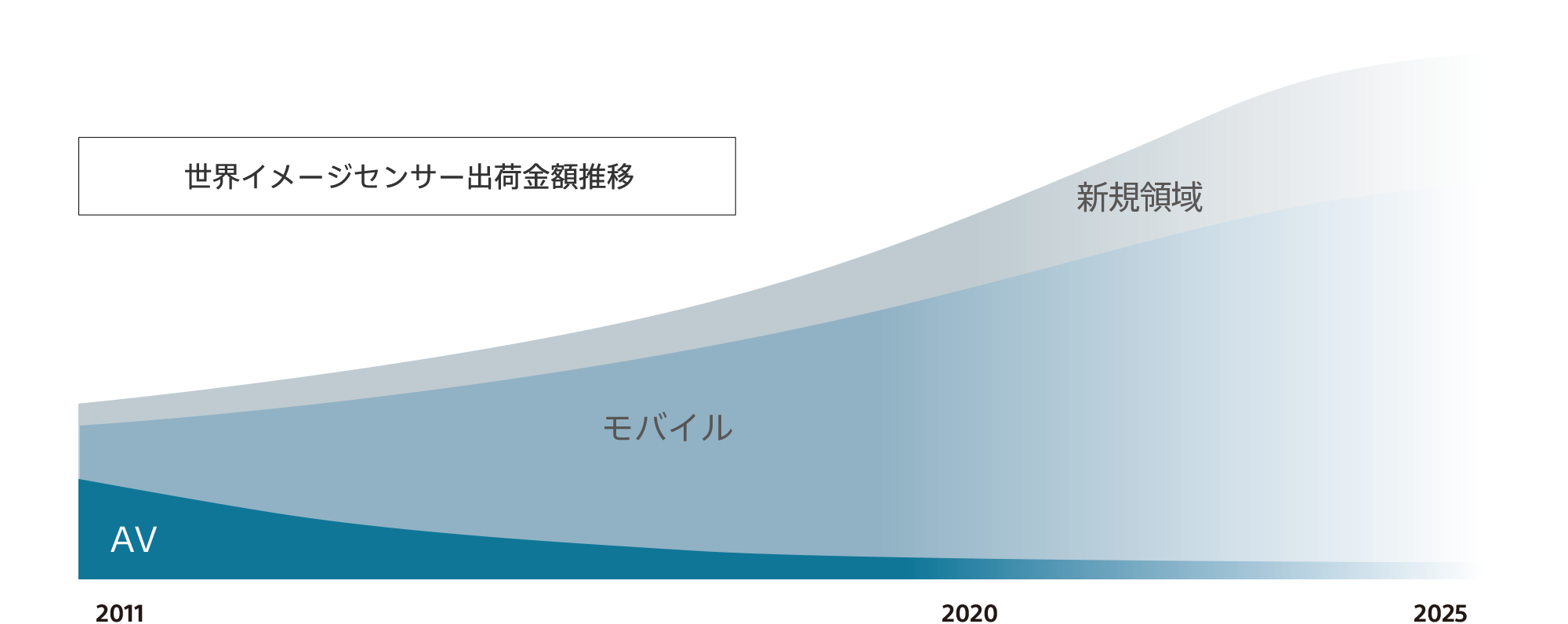

The “Vision-S” announcement at CES2020 took everyone by surprise. At that time, Sony’s president stated that the future will be the age of mobility. He made this statement after building a car himself, so it was very persuasive. At the same time, I feel that Sony is prepared to focus on the mobility field in the future. From this announcement, we can predict that the market share of image sensors for mobility applications will increase in the future. Sony’s forecast for global image sensor shipments is shown below. This forecast also predicts that the mobile field will become saturated and new fields (mobility, factory automation, and security) will increase.

Quote from: Sony Semiconductor Solutions(https://www.sony-semicon.co.jp/technology/direction/)

In addition, Vision-S uses 40 sensors, including more than 20 cameras and LiDAR. When automated driving becomes the norm in the near future, cars equipped with more sensors than this will be produced in large numbers. If that happens, there is a possibility that more image sensors than the current smartphones will be produced.

Currently, ON Semiconductor is in first place and has more than half of the market share for CMOS image sensors for automotive applications (2017), although the data is a bit old. It is expected that Sony and Samsung will enter the mobility business in earnest in the future. If Sony can take the top spot in image sensors for mobility in the future, it will probably continue to be the leader in the image sensor world. On the other hand, if Sony cannot take the top spot, it may gradually lose its market share.

コメント